Category: Seed

December 6, 2017

This article was written by XSeed Capital Partner, Jeff Thermond.

Almost half of the initial pitches we view at XSeed do not contain a Five Year Projected Financials slide. Another quarter have a forecast, but it only goes out two years. So, three quarters of the entrepreneurs we meet start out with a pitch deck missing an

Read More

June 22, 2015

This XSeed blog was written by XSeed Capital Partner, Robert Siegel, and originally appeared on VentureBeat.

At XSeed Capital we are introduced to over 500+ new startup opportunities every year, and we directly meet or talk to 150–200 of these companies. In this context, I am sometimes asked what is the “biggest mistake” that a

Read More

April 16, 2015

This XSeed blog was written by Venture Partner, Jeff Thermond, and originally appeared on Forbes.

I remember my first Board of Directors meeting. It was a disaster. I made the naïve mistake of laying out several different business model options for our startup and then asked for the board’s opinion without first putting forth my

Read More

September 3, 2014

This XSeed blog was written by Venture Partner, Jeff Thermond, and originally appeared on Forbes.

LinkedIn and other companies draw hundreds of millions of users every day in large part thanks to their ability to acquire, transform and leverage many types of data. The use of a data roadmap, which is a disciplined way to

Read More

June 25, 2014

This XSeed blog was written by Venture Partner, Jeff Thermond, and originally appeared on Forbes.

In a previous article, I argued that great startups solve large, and even more importantly, immediate pain points for customers by positioning products more like a pain killer and less like a vitamin. This is the essence of product/market fit:

Read More

June 5, 2014

This XSeed blog was written by Venture Partner, Jeff Thermond, and originally appeared on Forbes.

Whenever I talk to a startup CEO, the conversation moves quickly to the company’s growth rate for bookings and revenue. Too often, they’re not what the entrepreneur had hoped for. I want to offer a few thoughts on why that

Read More

May 9, 2014

This XSeed blog was written by XSeed Capital Partner, Robert Siegel, and originally appeared on VentureBeat.

Oh, you lucky dog! When you started the process of raising money you hoped it would go well, but you didn’t really know for sure. The first few fundraising pitches were a little rough, and you had some doubts

Read More

April 10, 2014

This XSeed blog was written by Venture Partner, Jeff Thermond, and originally appeared on Forbes.

When asking entrepreneurs how their pitch went to a new VC firm, I often hear, “It was going really great until I got asked this question which really threw me. It was completely off topic. Things didn’t go so great

Read More

March 4, 2014

This XSeed blog was written by Venture Partner, Jeff Thermond, and originally appeared on Forbes.

Somewhere in every entrepreneur’s pitch deck is a slide on pricing. Even when a pitch is going well, as a venture capitalist, I often find the pricing slide to be the weakest of the entire deck.

I’d like

Read More

September 5, 2013

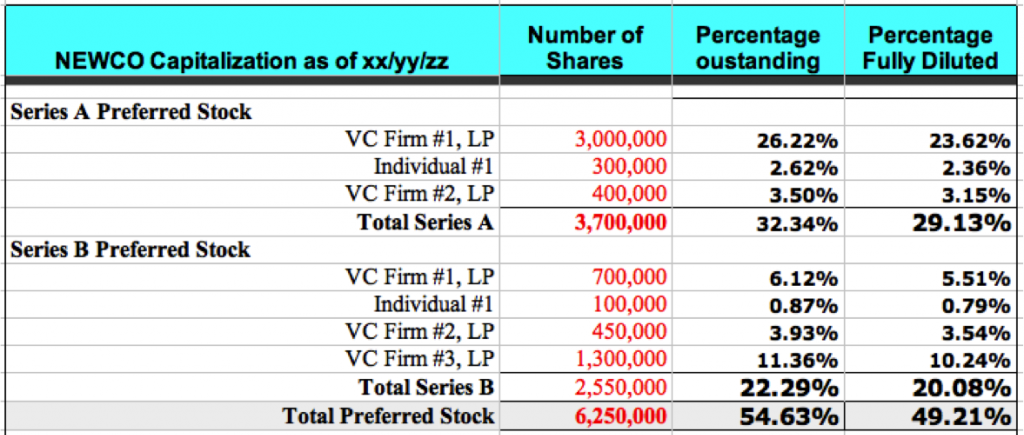

A capitalization table (often referred to as a “cap table”) is a tool used to display the ownership of a company. Given that venture-backed firms are constantly raising new capital, the ownership structures of these companies can be relatively complex as each round of funding may bring in new owners and is often based on different valuations. Consequently, it

Read More