This article was written by XSeed Partner Robert Siegel and appeared in the Systems Leadership section of casasiegel.com.

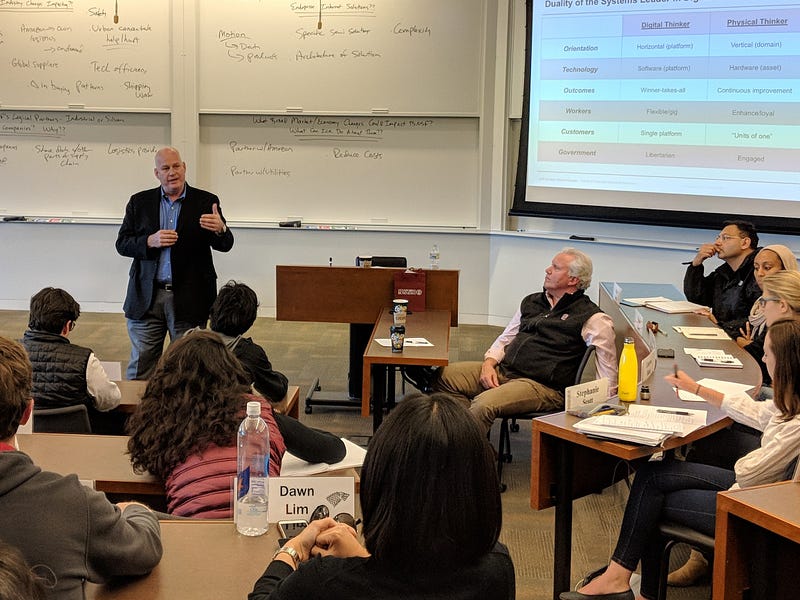

Carl Ice runs one of the largest railway systems in North America. And while most of our students may never work for a big railway company in their careers, they all gained a much clearer understanding of the importance and operational excellence these massive arteries provide to our global economy.

For BNSF, the position of incumbency is powerful — miles of rail have been laid over a century which connect this vast country. Railways opened up the western United States for commercial expansion in the nineteenth century, and provided the backbone of the industrial revolution which shaped the country’s economic position in the world. And while change in an industry like this does not happen overnight, even BNSF is being forced to react to forces in its market — changing consumer buying behaviors, the potential for new modes of moving goods and services (e.g. autonomous trucks, an improved Panama Canal, etc.) and, of course, digitization for improving outcomes and operations for customers.

Ice shared with us several key lessons from his more than forty years of experience in the railway industry. And as he pointed out several times, “Let’s face it — trains are cool.”

Understanding the Role of Market Share

Understanding the Role of Market Share

A key goal for every Systems Leader is to establish a position of strength for his/her company in a competitive landscape, and a key tactic is to optimize the market structure to play to the advantages of one’s company. The attributes of successful barriers to entry are widely known and understood; these include existing customer relationships, new technologies developed internally or by partners, and operating rhythms inside of an organization that can be transferred to other opportunities and markets with speed and efficiency.

An important data point for a Systems Leader to understand is the role of market share in a particular market segment. Can the market support multiple players of roughly equal sizes, or do the needs of the market drive customers towards one widely adopted solution that naturally evolves and becomes an established or de facto standard? Does the market move towards consolidation due to network effects or economies of scale? A key question for a Systems Leader to answer is what is the logical end-state of a market in terms of competitive solutions, and then to determine what position his/her company can realistically achieve in that natural state.

Systems Leaders thus need to explore how they can optimize a market structure to their advantage. When one considers Amazon and its acquisition of Whole Foods, one has to ask what this action will mean for other supermarkets and suppliers of food and consumer products. Does Amazon have the ability to use its scale in online sales and its distribution centers to optimize customer experiences to its advantage? Will Amazon also be able to shape other industries such as healthcare? Is every industry vulnerable to these types of attacks from a company like Amazon?

For Ice and the team at BNSF, their understanding of their internal capabilities is profound. What stood out was how strong of an operator Ice and his team are — their ability to understand the metrics that determine the effectiveness of the company, and what needs to be done to increase performance (e.g. locomotive velocity as a function of reliability, scheduling, engine efficiency, etc.) is baked into the operating rhythms of the company at the highest levels.

Ice discussed extensively about the need for Systems Leaders to get outside of their corporate headquarters and spend time gathering primary data with field operations. He pointed out that every year he rides at least 12,000 miles on the railroad so that he can see first-hand the status of the network and how well things are functioning. In addition, Ice talked about how his team continues to bring the discipline and operating rhythm of a public company into how they measure and report their activities — even though they are no longer public since being acquired by Berkshire Hathaway.

One statistic that he highlighted is that 15% of goods that move between cities in the United States are moved on their railroad. And while this is an impressive market segment share, it also helps set a criteria for understanding how they fit into the broader global economy and how other modes of transportation might impact the competitive landscape for the company. And with a well-run business encompassing large market segment share in the railroad space, Ice and his team have the ability to choose those areas where they can pick their spots using digital technologies to drive better customer outcomes. Incumbency thus has advantages for where and how BNSF can play offense versus defense in their digital industrial transformation.

Who Will Serve the Industry and Why Will They Serve It?

Unlike previous generations of industrial solutions, one new basis for competitive advantage is the move from fully vertical proprietary products to collections of best-in-breed components that connect via open standards or APIs. However, it is important for Systems Leaders to remember that market share and volume drive standards, not the other way around. As such, those parts of the stack that need to be standardized are the interconnections between stack components — not the components themselves. As such, the ability to help shape a market’s development requires a collaborative approach with other players so that companies can drive growth in those areas in which they seek to win — not necessarily in every area.

As technologies themselves continue to evolve and also get more effective and smarter in delivering best-in-class solutions through the introduction of artificial intelligence, machine learning, etc. into the technical stack, the mindset change of moving from a point solution to a flexible platform becomes a required attribute for enabling customer outcomes.

In the changing digital industrial world, which combines the blending of physical and digital product and services, one trend we have previously discussed is the movement of digital companies into more traditional industries, as well as incumbents looking to add digital capabilities internally to deliver better customer outcomes. However, industrial market structures do not tend to radically realign in a quick manner — especially given the nature of the products and services and the often corresponding level of government regulation around issues of safety (healthcare, mobility) and the long life-times of products (e.g. locomotives, power plants, etc.). Given these dynamics, Systems Leaders need to comprehend that even if some of the new underlying technologies for customer solutions such as artificial intelligence, machine learning, cloud-based computing, etc. might migrate from traditional digital industries to industrial ones, it may not be logical outcome that the traditional suppliers of these technologies will move directly into these industries and that they will take disproportionate market share from incumbents.

For example, in the airline and railway industries, incumbent suppliers are more likely to have long-term relationships with customers and have a better understanding of markets dynamics. In addition, current suppliers are likely to remain active in the market for the foreseeable future as it is currently core to their existing businesses. Are Boeing and Airbus more likely to receive better products and services about how to operate their firms from companies such as GE and UTC, or from traditional technology companies such as Microsoft and Salesforce? The former supplies multiple products that have been used by aircraft manufacturers and railway operators for decades; the latter provides software platforms that are largely used in the back-end of these companies. While all four of these firms offer goods and services that are beneficial to Boeing and Airbus, how deep is the domain knowledge of the traditional technology companies in the aviation vertical? Are they likely to spend huge dollars and resources to staff up and gain as strong an expertise in the vertical segment compared to the other parts of their businesses (i.e. the traditional digital platforms they provide)?

Stated differently, how will competitors face off against each other? Will digital companies be able to match up against industrial companies when trying to win business? How will industrial companies be able to deliver technical solutions when competing against digital companies?

For Ice, he and his team look for how aggregators can join together to deliver better customer outcomes — working with companies to determine where to use home-grown technology solutions and where to work with others that can provide insights into operational efficiencies, productivity improvements and new services for customers. As Ice highlighted, BNSF is clearly in the railroad business, but he believes that what a railroad does and the services it delivers will grow and change as they interconnect more broadly with other parts of the global economy for moving goods — ports, last mile delivery and even eCommerce.

To do this well, BNSF and its key partners must have extremely tight relations which inevitably lead to some level of bespoke customizations that are based on standardized technological building blocks. In this type of instance, markets tend not to organize into a “winner takes all” solution, but rather into a set of customized goods and services for each company that is built on best-in-class technologies that deliver optimal customer outcomes.

Systems Leaders can thus think about how being an incumbent is a net positive or net negative in optimizing one’s market. At its best, incumbency affords established players the ability to leverage existing relationships and industry knowledge to continue to serve current customers and channels. If an organization truly focuses on customer outcomes and uses its knowledge of customer goals, it should be able to offer best-in-breed solutions and drive market share and growth within a client or with new customers.

On the other hand, incumbency can also be a boat anchor if a company does not seek to understand changing needs of its customers. And for Ice and the team at BNSF, this brings us back to the importance of getting outside of one’s own building to gather primary data on what are customers’ needs, what type of solutions can best meet those needs, what is the aggregate level of components that deliver the best customer outcomes, and what are the global socioeconomic trends that could change the competitive landscape.