Tag: Finance

December 17, 2014

XSeed Capital is very excited to announce our recent investment in Chatous, an online and mobile service that enables people to have conversations with others around the world in a safe, private and protected manner. The company, which began as a project in one of Jure Leskovec‘s classes at Stanford University, matches individuals with others based

Read More

May 9, 2014

This XSeed blog was written by XSeed Capital Partner, Robert Siegel, and originally appeared on VentureBeat.

Oh, you lucky dog! When you started the process of raising money you hoped it would go well, but you didn’t really know for sure. The first few fundraising pitches were a little rough, and you had some doubts

Read More

May 7, 2014

In venture capital, investors strive to find entrepreneurs that are “authentic” to a market and who are also addressing a large problem. XSeed is excited to announce our recent investment in CirroSecure, a firm where we have found both great entrepreneurs and also a big opportunity that is not being adequately solved with existing solutions.

When we first met Vikrant

Read More

May 5, 2014

Lights-out operations of data centers has long been a vision pursued by many IT organizations. In the last 15 years, companies such as Opsware (acquired by Hewlett-Packard), Opalis (acquired by Microsoft) and DynamicOps (acquired by VMware) have led the first two waves of automation that delivered increasing levels of productivity to data center operations teams, from bare-metal servers to

Read More

March 27, 2014

This XSeed blog was written by Venture Partner, Jeff Thermond, and originally appeared on Forbes.

When I see something happen again and again in Silicon Valley, I use the phrase “Prevailing Pattern of Practice in the Valley” to describe it. When things work well here, they get copied broadly.

Over the last twenty

Read More

February 9, 2014

This XSeed blog was written by Venture Partner, Jeff Thermond, and originally appeared on VentureBeat.

Generally speaking there are three types of exits: going out of business, getting acquired, and going public. Often overlooked but important to keep in mind is what I call “The Trapped in Amber Company.” It’s too big to shut down,

Read More

January 29, 2014

This XSeed blog was written by XSeed Capital Partner, Robert Siegel, and originally appeared on Forbes.

When XSeed Capital engages initial discussions with a startup, the conversations usually surround traditional topics: what is the size of the market opportunity, how good is the current product/market fit, what skills does the team have or want to

Read More

December 16, 2013

This XSeed blog was written by Venture Partner, Jeff Thermond, and originally appeared on Forbes.

So you’ve got a great idea for a new startup. Congratulations! Before you begin, you might want to think twice about the scope of your great idea.

Put simply, the question is whether your great idea is a

Read More

October 10, 2013

In XSeed’s first fund, we allocated a portion of capital to entrepreneurs pursuing breakthrough innovation at the intersection of IT and other technical disciplines. Our reasoning in pursuing these and a handful of other such investments was straight- forward: We believed, given the cost-performance vector of IT, that it would rapidly transform other disciplines and that companies could be

Read More

October 3, 2013

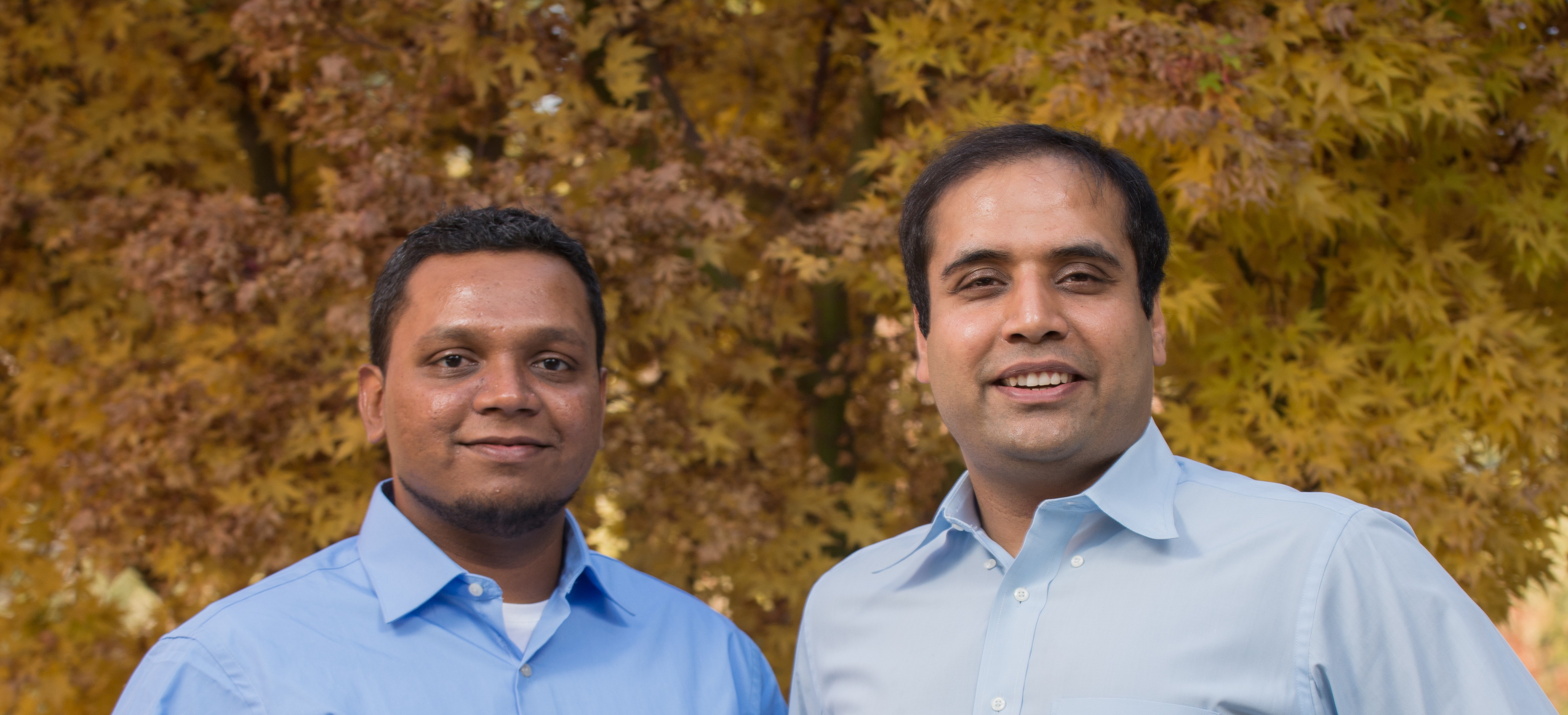

In this day of instant communication, companies are both striving for and also required to pay close attention to the feedback of their customers. Stanford spin-out DropThought was founded a little over two years ago by Karan Chadhry and Ajith Ravi to provide a solution that reduces friction

Read More